Market & Economic Commentary: Q3 2023

A Note to our Clients, Friends, Family and Business Partners

We have been watching with horror the devastation and loss of innocent lives that is the result of Hamas’ violent attack on Israel this past weekend. We want to take a moment to offer support to those who are grieving and to those who are anxiously awaiting news from family and friends. We pray for peace.

Quarter in Review

Markets were off to one of the best starts in decades during the first seven months of 2023, as economic data strengthened market participants’ view that a recession could be avoided and that the Federal Reserve could soon cease monetary tightening and perhaps might even begin lowering interest rates.

However, turbulence hit in August as persistent economic strength and plateauing inflation caused markets to reassess the rosy view. Comments from the Federal Reserve indicated the possibility of elevated interest rates for some time to come, challenging lofty equity valuations.

By September, the benchmark 10-year U.S. Treasury yield hit levels unseen since 2007. Risk assets suffered from the relentless rise in interest rates joined by headwinds from an auto strike, the specter of a looming government shutdown, rising oil prices, lackluster growth overseas (particularly China), and the restart of student loan payments. 1

While returns from equities are still positive for the year, they finished the quarter down across the board. In the United States, the NASDAQ declined by -3.94%, the S&P 500 by -3.27%, and the Dow by -2.10%. International Developed and Emerging Markets also followed suit, with the MSCI World ex USA index down -4.10% and the MSCI EM index down -2.93%. 2

Bond markets continued their struggles in the face of surging yields as financial markets priced in a lower chance of recession, implying higher interest rates for longer. Ten-year government yields hit new year-to-date highs in the U.S. and Eurozone.

Yield curves also remained inverted but flattened over the quarter as yields rose more at the long end than at the short end. The Bloomberg U.S. Aggregate Bond Index finished down -3.23% for the quarter. At the same time, the Bloomberg Global Aggregate Index, representing bonds from developed and emerging markets, ended down -3.59% for the quarter. 3

Economic Growth Persists, and so does Inflation

The economy keeps powering ahead. There have been some signs of cooling as the pace of job creation has slowed, fewer workers are inspired to quit in hopes of landing a better paying alternative, wage growth has slowed, and many broad inflation measures are lower than they were at the beginning of the year. However, consumption remains strong, and the labor market remains relatively tight. Although student loan borrowers will now have to resume loan payments, homeowners with low-rate mortgages locked in over the past years have disposable income to spend. Additionally, according to the Wall Street Journal, older consumers with padded savings that accounted for 22% of consumer spending in 2022 are likely to continue to contribute robustly to consumer spending. 4

1 Morningstar Direct, as of September 30, 2023

2 Morningstar Direct, as of September 30, 2023

3 Morningstar Direct, as of September 30, 2023

While a robust economy is normally positive for stock prices, the news of current economic resiliency implies a prolonged period of higher interest rates. This in turn weighs on expectations for capital spending and requires a larger discount on future expected earnings. With the market, as always, looking past the current conditions, stock prices have been pricing in tighter financial conditions ahead and the negative impact that could have on company earnings and economic growth.

Meanwhile, rising oil prices, coupled with a tight labor market, have reignited concerns about inflation pressures. Elevated oil prices could mean the difference between moderating inflation or economy-wide price increases that persist, increasing the chances that the Federal Reserve may impose more interest rate hikes.

Several factors have driven the rise in oil prices. The U.S. economy has been stronger than expected, consuming more oil than forecast over the past year. Also, Saudi Arabia and OPEC+ (which includes Russia) announced they would restrict supplies until the end of the year (and perhaps beyond), causing global supply to tighten and push prices further up. Finally, the eruption of violence in the Middle East in October has further increased risks to oil supply.

Since the end of June, West Texas Intermediate crude oil prices climbed toward $100/barrel in trading, the highest in 10 months for the U.S. benchmark, before retreating some in October before the fighting in Israel. Meanwhile, gasoline prices jumped 11% from July to August, driving more than half of overall monthly inflation. Those trends continued into September. 5

Source: Bloomberg, as of September 30, 2023

5 Where our oil comes from - U.S. Energy Information Administration (EIA). (n.d.). https://www.eia.gov/energyexplained/oil-and-petroleumproducts/where-our-oil-comes-from.php

Final Thoughts

Maintaining a disciplined long-term focus when it comes to investing can be incredibly hard. Ignoring the deluge of headlines is difficult, as we feel compelled to respond to circumstances that continually change and evolve. This is particularly true when the news we encounter is unsettling and our evolutionary instincts lead us to prioritize seeking shelter and safety.

However, research has shown that we are poor at evaluating the value of long-term rewards and tend to focus too heavily on short-term payoffs. Therefore, our decisions often reflect our current emotional state, often fear or anxiety, and are rarely made with long-term outcomes in mind.

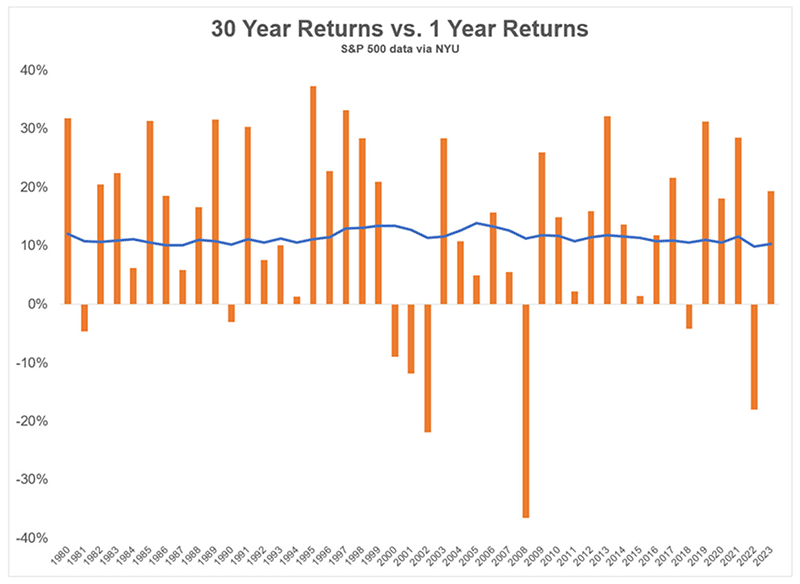

If we take a look at the experience of a hypothetical disciplined long-term investor by using rolling 30-year average annual returns on the S&P 500 since 1950 (the blue line on the chart below) and compare that to the short-term ups and downs of the S&P 500 each year for the last 30 years (the orange bars), we can see that, despite year to year volatility, the average return from staying invested has been remarkably stable for over seven decades.

Source: A Wealth of Common Sense (https://awealthofcommonsense.com/2023/07/one-year-returns-dont-matter), data as of July 30, 2023

When recessions, wars, or political turmoil introduce a “wall of worry” staying disciplined is crucial. Challenges are a natural part of the investment landscape, and the markets have a remarkable capacity to adapt. We remain vigilant in closely monitoring these developments and adjusting our strategies accordingly.

If you have any questions or concerns about your investments or the current market environment, please reach out to our team. We greatly value your trust and look forward to navigating the path ahead together.

Index Disclosure and Definitions

Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the occurrence of which would have the effect of decreasing historical performance results. Actual performance for client accounts will differ from index performance.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization.

Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ.

The Nasdaq Composite Index (NASDAQ) measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market and includes over 2,500 companies.

MSCI World Ex USA GR USD Index captures large and mid-cap representation across 22 of 23 developed markets countries, excluding the US. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets (as defined by MSCI). The index consists of the 25 emerging market country indexes.

Bloomberg Barclays US Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States – including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year.

Bloomberg Barclays Global Aggregate (USD Hedged) Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers. Index is USD hedged.

© Morningstar 2021. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

The Kaminsky-Silverman Group utilizes Symmetry Partners, LLC (SP), which is a third-party service provider that supplies market data and assists in creation and monitoring of factor-based investment models. SP is also an investment advisory firm registered with the Securities and Exchange Commission. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. Please note the material is provided for educational and background use only. Moreover, you should not assume that any discussion or information contained in this material serves as the receipt of, or as a substitute for, personalized investment advice.

Diversification seeks to improve performance by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market. Past performance does not guarantee future results.

This material is confidential and is provided for informational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your investment. Any opinions, expectations and projections within this document are solely those of the Portfolio Manager(s) identified, and do not necessarily represent the viewpoint of Shufro, Rose & Co., LLC or other Portfolio Managers at the firm. This report was prepared by Shufro, Rose & Co., LLC and is presumed to be correct. Shufro, Rose & Co., LLC is an investment adviser registered with the Securities and Exchange Commission. ADV Part 2A is available upon request or at https://adviserinfo.sec.gov. Please contact Shufro, Rose & Co., LLC at (212) 754-5100 with any questions.